Last week I posted Tale of Two Ogden Cities: In Charts showing market metrics and trends for the East Bench of Ogden compared to the Trolley District area just east of Downtown. One of the most remarkable charts showed the trend on prices. Here is that chart again:

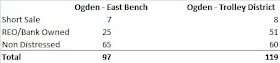

So what could be driving this decrease in average sale price? To figure that out, I took a sample of all the homes that sold in these neighborhoods over the last year. Here is a breakdown:

It looks like there are a significant amount of distressed sales (bank owned and short sale) occurring in both markets. Here are the percentages illustrated:

So what does this mean? Well, the red and blue categories are where you want to be buying investment grade "scratch and dent" properties. The green category is where you want to be selling.

The non-distressed sales compete with the distressed sales in the market. However, distressed sales typically are not in good physical condition in comparison to non-distressed sales. Therefore, the distressed sellers will discount these beat up properties to move them off their books.

What has happened, especially in the Trolley District, is that with half of all sales being distressed, and the price discounted accordingly, the average price is pushed down as we see in the chart at the top. The average price for non-distressed homes has come down over time but is not nearly as much as the distressed sales. This math all gets mashed up together to produce our trendline in the top chart.

We can see that the East Bench has this dynamic going on as well but to a lesser magnitude. With the mix of distressed sales being diluted, that explains why the average price has not come down nearly as much as the Trolley District.

Nevertheless, homes can and will be sold at top dollar in this market. The catch is that the home needs to be free from deferred maintenance and in pristine condition. Here is an example. Patience is also necessary because market times are 4 to 5 months for these kinds of properties right now.

No comments:

Post a Comment

Please keep comments appropriate and respectful for a real estate blog. Personal rants, spam, and off topic comments will be deleted.