I just closed on these three condo units in a very interesting transaction. This deal involved 3 condo units in small 4 unit complex. The owner of these units had majority control of the HOA as well. When I listed the properties, his instructions were to sell them all as a package and not piece by piece. So, we listed them at $89,900 each ($269,700 total) and advertised each unit as needing to be sold with the others.

The market gave us some resistance to this plan at first. First-time homebuyers kept wanting to purchase just one unit. We had to turn them away. Yet, investors (our target audience) were not too excited about the prospects of the package because the three units would require three separate mortgages with three separate appraisals and three times the closing costs. That was a significant barrier. However, my client was open to the idea of seller financing to overcome this hurdle. Once we got the figures together I notified my investor-clients of the opportunity to seller finance all three of these units. The seller's terms were that he wanted 20% down to reduce the risk of the deal.

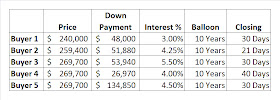

Once the notice went out, we received 5 offers. No two were alike. Here is what we received:

Mitigating risk was the seller's main concern. Based on these offers, if you were the seller, which one would you pick? The seller chose Buyer 5's offer. There is a strong inverse correlation between risk and down payment. With 50% down, there is virtually a 0% chance of default by the buyer.

We also ended up negotiating the interest rate and balloon date after the initial offer. The parties agreed to a 5.25% note rate over an 8 year soft-balloon with the rate adjusting to 9% thereafter. The loan was amortized on a 30 year basis.

After finalizing terms, we proceeded with the transaction. The inspections revealed about $3,000 of deferred maintenance that the buyer wanted addressed. We reduced the contract price by $2,700 and moved forward to closing.

Congrats to the buyer and seller in the purchase and sale of these units. This is truly one of those win-win transactions where everyone benefits. I also have to thank Kori Cannon at Bonneville Superior Title for her expertise in addressing the complexities and nuances of the seller finance details of our transaction. Her work made my ours a lot easier.

If you have investment property that you want to sell, CONTACT ME, and let's discuss.

No comments:

Post a Comment

Please keep comments appropriate and respectful for a real estate blog. Personal rants, spam, and off topic comments will be deleted.