First introduced in 2006, RPX converts public source data on completed home sales into a single daily price per square foot (ppsf) representing a true surrogate for point of sale values. RPX represents the best available surrogate for a spot price for the residential real estate market.

For those of you interested in learning more about this, you can find it HERE.

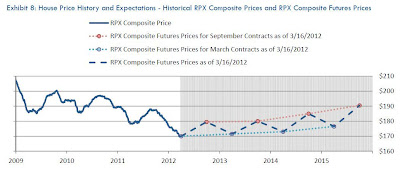

Anyway, what does the futures market for RPX tell us about future house prices? Queue chart please (click to enlarge):

It appears that we are bottoming out at this very moment and prices will move gently upward over the next few years with acceleration after 2015. While this is upward movement, the improvements could best be described as "flat" in the near term. That is still better than the slight sagging the market has experienced since 2009. It also means that housing will continue to be a solid investment in real terms.

Hopefully, the index is right and we can enter a new phase of price stability in the housing market. That should make things better when it comes to getting quality appraisal work done.

No comments:

Post a Comment