Wednesday, March 28, 2012

FOR SALE: FRANK LLOYD WRIGHT School of Design - Architectural Treasure!

Last September, I listed 2508 Jackson Ave. in the Eccles Historic District that was designed by a student of Frank Lloyd Wright. However, some repairs needed to be made to the property. The repairs were delayed so the home was taken off the market so they could be made.

The repairs are done and the home is now ready to show in all its splendor. Here is the updated video:

The home is 4870 SQFT and has 6 bedrooms, 5 bathrooms, 3 kitchens, 2 car garage, a pool, .68 acres, and all the woodwork you could want inside.

If you are interested in viewing this exquisite property to purchase, email me or please give me a call at 801-390-1480.

Labels:

architecture,

brick,

Downtown Ogden,

picture,

restoration

JUST SOLD! Landed West Point Rambler

Today I closed on a home in West Point with a buyer.

With the husband wanting land and the wife wanting a house, this home was our compromise. The house is 3380 SQFT and sits on 2.7 acres. There is also a significant workshop sitting on the property as well.

The home was purchased in 2007 for $423,000. Then in April 2010, the property sold as a short sale for $288,000 to the most recent sellers. The owners experienced a job transfer abroad and the home went up on the market in September 2011 for $339,900. Through negotiations, I was able to get my clients a price of $310,000 on the home and we closed at that price today.

Congratulations to my buyers on their new home!

If you are looking for a home, contact me and we'll find the one that is right for you.

Labels:

architecture,

market,

picture

Monday, March 26, 2012

Ogden's Urban Art

Ogden City has made an effort to beautify some of its urban spaces through creativity. What is a barren concrete facade to one becomes a blank canvass to another. Here are a few photos from around Ogden City of such efforts:

These two above murals are located at the parking facility at 23rd St. and Washington Avenue. Interestingly, this one below is on the brick buildings adjacent to it:

Of course, almost everyone is familiar with this one on 24th St. and Grant that greets you as you enter the city from I-15:

Finally, a parking garage is probably the place that needs the most decoration. Here is an interesting work that ties in the concrete supports to make them part of the painting.

Kudos to those making our city interesting and vivacious.

These two above murals are located at the parking facility at 23rd St. and Washington Avenue. Interestingly, this one below is on the brick buildings adjacent to it:

Of course, almost everyone is familiar with this one on 24th St. and Grant that greets you as you enter the city from I-15:

Finally, a parking garage is probably the place that needs the most decoration. Here is an interesting work that ties in the concrete supports to make them part of the painting.

Kudos to those making our city interesting and vivacious.

Labels:

adventure,

architecture,

picture

Friday, March 23, 2012

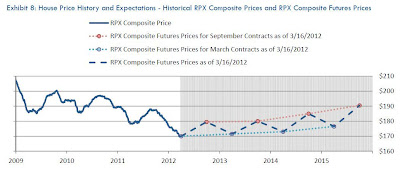

RadarLogic: For House Prices, It's All Up From Here!

It's all up from here! At least that is the findings from RadarLogic's RPX index which is tied to housing prices nationwide. The index is traded on the Chicago Board Options Exchange and as many indexes has a futures variation as well. Here is a description of the RPX:

For those of you interested in learning more about this, you can find it HERE.

Anyway, what does the futures market for RPX tell us about future house prices? Queue chart please (click to enlarge):

It appears that we are bottoming out at this very moment and prices will move gently upward over the next few years with acceleration after 2015. While this is upward movement, the improvements could best be described as "flat" in the near term. That is still better than the slight sagging the market has experienced since 2009. It also means that housing will continue to be a solid investment in real terms.

Hopefully, the index is right and we can enter a new phase of price stability in the housing market. That should make things better when it comes to getting quality appraisal work done.

First introduced in 2006, RPX converts public source data on completed home sales into a single daily price per square foot (ppsf) representing a true surrogate for point of sale values. RPX represents the best available surrogate for a spot price for the residential real estate market.

For those of you interested in learning more about this, you can find it HERE.

Anyway, what does the futures market for RPX tell us about future house prices? Queue chart please (click to enlarge):

It appears that we are bottoming out at this very moment and prices will move gently upward over the next few years with acceleration after 2015. While this is upward movement, the improvements could best be described as "flat" in the near term. That is still better than the slight sagging the market has experienced since 2009. It also means that housing will continue to be a solid investment in real terms.

Hopefully, the index is right and we can enter a new phase of price stability in the housing market. That should make things better when it comes to getting quality appraisal work done.

Labels:

chart,

economy,

House Prices,

market

Thursday, March 22, 2012

Weber County Inventory Snapshot: March 2012

Last October, I posted about Weber County housing inventory levels to see where the hot spots in the markets were. Since that time, it appears that the winter season has caused inventory levels to decline while sales have been fairly consistent over the same period.

Here is a table of Weber County cities ranked lowest to highest on the Months of Inventory available.

This is a loose measure of where "healthy" markets exist. We typically like to see inventory levels below 6 months. Anything above that could be considered a "buyers" market.

Granted, there are some things that could distort these figures. This chart doesn't reflect distressed sales as opposed to retail sales. Nevertheless, it is still a good measuring tool. It will be interesting to watch the sales unfold this Spring.

Here is a table of Weber County cities ranked lowest to highest on the Months of Inventory available.

This is a loose measure of where "healthy" markets exist. We typically like to see inventory levels below 6 months. Anything above that could be considered a "buyers" market.

Granted, there are some things that could distort these figures. This chart doesn't reflect distressed sales as opposed to retail sales. Nevertheless, it is still a good measuring tool. It will be interesting to watch the sales unfold this Spring.

Labels:

chart,

economy,

investing,

market,

sales volume

Tuesday, March 20, 2012

Ogden Redevelopment: Ogden Temple, IRS Building, Hilton Hotel and More...

While driving around this morning, I thought I would take the opportunity to snap some photos of some redevelopment projects currently underway in Downtown Ogden.

The Ogden Temple continues to plod along. There have been some delays as more prep work is done to clear the way for underground parking at the site. Water table issues stopped work for a while so engineers could retool and budgets could be realigned. However, construction on the main edifice has begun to show. Here you can see the new concrete boxes being framed and poured just east to the main framework of the old structure.

Crews just recently were able to "dry-in" the structure and are now at work putting on the exterior finishes. This new building is located at the corner of 23rd Street and Washington Blvd.

This new structure has been under construction for some time. The builders are behind schedule but the interior is currently being finished so the project should be completed soon. The structure will compliment other IRS facilities located on the block.

Several years ago Boyd K. Packer came to our Chapel for a Stake Conference. When he walked through the church he told our Stake President: "Don't you let anyone touch this building." To see what he was talking about, watch this video of the interior. The church is now making seismic upgrades to the building similar to those made to Ogden High School. Hopefully, the structure will last for generations to come.

The New Ogden Temple

The Ogden Temple continues to plod along. There have been some delays as more prep work is done to clear the way for underground parking at the site. Water table issues stopped work for a while so engineers could retool and budgets could be realigned. However, construction on the main edifice has begun to show. Here you can see the new concrete boxes being framed and poured just east to the main framework of the old structure.

The Ogden Hilton

Crews just recently were able to "dry-in" the structure and are now at work putting on the exterior finishes. This new building is located at the corner of 23rd Street and Washington Blvd.

The New IRS Building

This new structure has been under construction for some time. The builders are behind schedule but the interior is currently being finished so the project should be completed soon. The structure will compliment other IRS facilities located on the block.

Pioneer (4th Ward) Chapel Restoration

Several years ago Boyd K. Packer came to our Chapel for a Stake Conference. When he walked through the church he told our Stake President: "Don't you let anyone touch this building." To see what he was talking about, watch this video of the interior. The church is now making seismic upgrades to the building similar to those made to Ogden High School. Hopefully, the structure will last for generations to come.

Labels:

architecture,

brick,

development,

Downtown Ogden,

new construction,

picture,

restoration

Monday, March 19, 2012

Sales Up! February Posts 16% Increase Over Last Year

It appears that the sales recovery continues. Here is a chart showing sales changes over the same month the preceding year. Comparing months year-over-year is an excellent way to read past the normal seasonal changes that occur in sales volume in the real estate market.

As you can see, after a relative dip in sales early in 2011, the market appears to be rebounding and stabilizing with some sales growth. You can see the actual sales volume and the moving average HERE. The market appears to be thawing. If you need to buy or sell a home, contact me.

As you can see, after a relative dip in sales early in 2011, the market appears to be rebounding and stabilizing with some sales growth. You can see the actual sales volume and the moving average HERE. The market appears to be thawing. If you need to buy or sell a home, contact me.

Labels:

chart,

market,

sales volume

Saturday, March 17, 2012

Before and After: Photos from Ogden's Five-Points Past

Back in 1914, the local LDS folks of the Ogden 15th (Lynne) ward constructed a chapel. Here is a photo of that gothic edifice:

If you are an Ogden resident and the above photo resonates with an odd familiarity, there is a reason. Located at the intersection of 2nd Street and Washington Blvd., this building is now used by the Bank of Utah.

Quite the make-over. I don't know about you, but I prefer the original version. The white-wash, chimney removal, window replacements, window shutters, Gothic arch removal, and gable window ornamentation rework all seem to have robbed this building of its soul.

If you are an Ogden resident and the above photo resonates with an odd familiarity, there is a reason. Located at the intersection of 2nd Street and Washington Blvd., this building is now used by the Bank of Utah.

Quite the make-over. I don't know about you, but I prefer the original version. The white-wash, chimney removal, window replacements, window shutters, Gothic arch removal, and gable window ornamentation rework all seem to have robbed this building of its soul.

Labels:

architecture,

brick,

picture,

rehab,

restoration

Friday, March 16, 2012

Multi-Unit Market Update

It has been a while since I ran the numbers on the multi-unit market. Here is a look at the numbers through the end of 2011:

First, lets look at sales volume. Clearly we can see that a volume trough occurred in 2009. That was the most pessimistic year of the multi-unit market. In contrast, last year put sales volume nearly with par of sales in 2001. It appears we are improving in sales. However, to understand what is driving the market, lets take a look at sales according the the financing style of each transaction:

This chart is intriguing. A whopping 44% of ALL transactions are done in cash. That is up from 35% last year. That speaks of a tremendous amount of distress still in the market in 2011. Notably, seller finance and FHA/VA transactions were on the decline as a proportion of sales. Also, conventional transactions seemed to be increasing though not significantly.

Overall, I believe 2012 will be a transition year. Look for conventional financing to improve and the number of cash transactions to decrease from where they were in 2011. If those two things occur, it will be the mark of an improving investment property market. Nevertheless, those that are buying right now are making a killing in return-on-investment.

If you want to explore purchasing a great bargain on multi-unit property, contact me and we can put a plan together that is right for you.

Thursday, March 15, 2012

Irony of the Day: Burned-Down House

I was cruising through town today and came across this bit of irony. Check it out:

Wednesday, March 14, 2012

Real Estate Regulation and De-Regulation from The Hill

This year was an interesting and exciting Legislative season. While working on my committee, I saw several real estate related bills come through for discussion and debate. There were several more that were debated on the House Floor. Here is a summary of some of the Real Estate related legislation that will become law this year:

Window Egress and Zoning Enforcement

HB383 - This was a bill that I ran which dovetailed with SB178 that I reported on last year. My bill puts teeth into the law which prevents building officials from requiring owners of rental property to cut into the foundation of their properties in order to enlarge existing egress windows. The State Fire Marshall wrote the language for the bill and testified in its behalf at committee. This should bring an end to most of the egress window non-sense where owners have been forced to endanger their properties by cutting into old and fragile foundations.

Short Sales and Deficiency Collections

SB42 - This bill brings deficiency collection for short sales in line with those for foreclosure. Before this law passed, lenders had 6 YEARS to file a deficiency judgement against the seller of a property. Most lenders don't file these judgements because the financial status of the sellers makes the action pointless. However, in some cases, the lenders do file. If they do, they now have 3 MONTHS from the time of the short sale closing to do so. This should increase the number of short sales being worked in the marketplace and help us churn through our distressed inventory faster. That, in turn, should help us accelerate toward a full market recovery.

Property Tax Reductions for Urban Farms

SB122 - This bill allows parcels of land of 2 acres or greater that are zoned for uses other than agriculture in urban areas to be taxed at an agricultural rate when they are dedicated to that purpose. The bill closely follows greenbelt statute and allows the property to have reduced taxes as long as the property is in use for agriculture production. When the property is sold, the seller must pay up to 10 years of the difference between the taxes they paid and what they would have paid had it been taxed the full rate through that time. This should do two things. First, it should increase the number of viable agricultural operations in urban settings; second, it should create an incentive for the properties to stay in agricultural use over longer periods due to the lump tax due at time of sale.

Mortgage Fraud Prosecution

SB281 - This bill funds the Mortgage and Financial Fraud Unit of the State Attorney General's Office. The unit has been in hibernation for several years due to budget constraints. The funds were available this year to restart the unit and begin investigating bad actors in the market.

Good Landlord Program Changes

SB216 - This bill makes some changes to Good Landlord programs across the state. It creates reciprocity for certification between cities who have a GL program. It also restricts the fees that cities can charge for a business license to be no more than the actual cost of providing the license. Ogden landlords have nothing to worry about. The city charges $83 for a non-GL and $13 for a GL license when the actual cost to the city is $108. Ogden has been an excellent example of how to run a GL program. The bill also provides an appeal process in the even that a landlord is kicked off the program.

Zoning Enforcement

HB302 - This bill requires cities to issue notices to owners and property managers, if desired, when giving notice of zoning violations. It also requires that a notice be issued for each instance of a violation. This will likely affect owners in Ogden regarding mowing of yards. The city policy prior to this bill has been to send a notice once in the year and then move strait to issuing fines if the violation occurs again later in the same calendar year. This will require a notice for each instance of the violation.

Labels:

Downtown Ogden,

landlord,

market,

regulation

Monday, March 12, 2012

JUST SOLD! Bargain Breadbox Short Sale

I just sold this 4 bed 1 bath home in Ogden for a client.

I took this listing in July of 2011. The owners were retiring and moving out of state. We originally listed the home for $105,900. After a short period, it became apparent that the owners would need to move to their new destination and they would not be able to make two house payments on their new reduced retirement income. At that time we reduced the list price to $64,900 and began to work on the file as a short sale.

The home had many showings and we obtained a cash offer in September for $55,000. I submitted that to the bank immediately for review.

Bank of America, the seller's mortgage company, ran us through the gauntlet several times. Our negotiator with the bank also changed a couple times. Finally, after jumping through all the hoops, Bank of American came back to us in January with a counteroffer proposal of $57,000. The buyer accepted. It took Bank of America soem time to wrap up the process but when they did we quickly closed on the home.

Congratulations to my sellers!

If you are contemplating a short sale on your property, contact me and I can help you through the process.

I took this listing in July of 2011. The owners were retiring and moving out of state. We originally listed the home for $105,900. After a short period, it became apparent that the owners would need to move to their new destination and they would not be able to make two house payments on their new reduced retirement income. At that time we reduced the list price to $64,900 and began to work on the file as a short sale.

The home had many showings and we obtained a cash offer in September for $55,000. I submitted that to the bank immediately for review.

Bank of America, the seller's mortgage company, ran us through the gauntlet several times. Our negotiator with the bank also changed a couple times. Finally, after jumping through all the hoops, Bank of American came back to us in January with a counteroffer proposal of $57,000. The buyer accepted. It took Bank of America soem time to wrap up the process but when they did we quickly closed on the home.

Congratulations to my sellers!

If you are contemplating a short sale on your property, contact me and I can help you through the process.

Tuesday, March 6, 2012

Loading the Springs: Weber County's Pent-Up Demand

In understanding the housing market, it is important to understand market dynamics in light of the variables that are at play. Fundamentally, the housing market is driven by the activities of people. Jobs, family creation, plague, war, natural disaster, and other factors all affect how people demand housing in a particular location. Thus, it is important to know what people are doing and why.

While thinking on this on a long drive this week, I began to wonder how our sales volume in Weber County stacked up against the population count. How bad is the housing market? We know it is less than what it was at the peak of the bubble. But on a per person basis, what does that look like?

I started digging through the data and put together a chart showing "sales per person" for Weber County. The idea would be that the sales would be adjusted to reflect the change (or in this case growth) in population.

Since people need a place to live, it is reasonable to assume that an increase in people could correspond to an increase in sales volume. If all other things held constant, you would expect to see a per capita numbert that is consistent from year to year even as population increases.

So what does Weber County's chart look like? Queue the chart please:

Data was pulled from the U.S. Census and from the MLS for sales to drive this graph. As you can see, the normal estimate population growth line (in red) is very seldom followed. Unfortunately, I didn't have enough data go back further in time. However, the bubble is clearly apparent in the chart. Since the bubble has burst, it appears that sales are now about 25% below where they should be based on how our population has grown.

What does this mean? It means that for the time being, there is pent up demand in the market place. It is represented by people renting or living in their parent's basements instead of purchasing homes of their own.

At some point in the future, this gap will be made up and sales will be boosted just to return back to historical norms. Since the market is troughing right now, look for that correction upwards to come over the next several years. This is just one more reason that now is a great opportunity to buy a home or invest in real estate.

While thinking on this on a long drive this week, I began to wonder how our sales volume in Weber County stacked up against the population count. How bad is the housing market? We know it is less than what it was at the peak of the bubble. But on a per person basis, what does that look like?

I started digging through the data and put together a chart showing "sales per person" for Weber County. The idea would be that the sales would be adjusted to reflect the change (or in this case growth) in population.

Since people need a place to live, it is reasonable to assume that an increase in people could correspond to an increase in sales volume. If all other things held constant, you would expect to see a per capita numbert that is consistent from year to year even as population increases.

So what does Weber County's chart look like? Queue the chart please:

Data was pulled from the U.S. Census and from the MLS for sales to drive this graph. As you can see, the normal estimate population growth line (in red) is very seldom followed. Unfortunately, I didn't have enough data go back further in time. However, the bubble is clearly apparent in the chart. Since the bubble has burst, it appears that sales are now about 25% below where they should be based on how our population has grown.

What does this mean? It means that for the time being, there is pent up demand in the market place. It is represented by people renting or living in their parent's basements instead of purchasing homes of their own.

At some point in the future, this gap will be made up and sales will be boosted just to return back to historical norms. Since the market is troughing right now, look for that correction upwards to come over the next several years. This is just one more reason that now is a great opportunity to buy a home or invest in real estate.

Labels:

chart,

market,

rental,

sales,

sales volume

Subscribe to:

Comments (Atom)